Tax Incentives For Electric Vehicles Ireland - Government Electric Vehicle Tax Credit Electric Tax Credits Car, Currently, the €5,000 vrt relief on electric vehicles begins to taper off from €40,000, ending at €50,000. Ireland’s department of transport announced details of electric car subsidies in the coming year: Tax incentives and electric vehicles what can Ireland learn from other, A rebate of vehicle registration tax (vrt) of up to €5,000 and a €5,000 grant from the sustainable energy authority of ireland (seai). There are two grants in play:

Government Electric Vehicle Tax Credit Electric Tax Credits Car, Currently, the €5,000 vrt relief on electric vehicles begins to taper off from €40,000, ending at €50,000. Ireland’s department of transport announced details of electric car subsidies in the coming year:

Ireland rates well in incentives to move to electric vehicles FleetCar.ie, Vehicle registration tax (vrt) is a tax to be paid when and imported vehicle is registered in the irish state. €11.5 million has been allocated for grants this year via the espsv24 grant scheme, to enable owners of small public.

Overview Electric vehicles tax benefits and incentives in the EU, The espsv24 grant scheme is now open. From 1 july 2023, the purchase premium will drop from.

Drivers who make the switch to evs also benefit from government purchase incentives up to a value of €10,000 (€5,000 vrt relief and €5,000 seai grant), a €600.

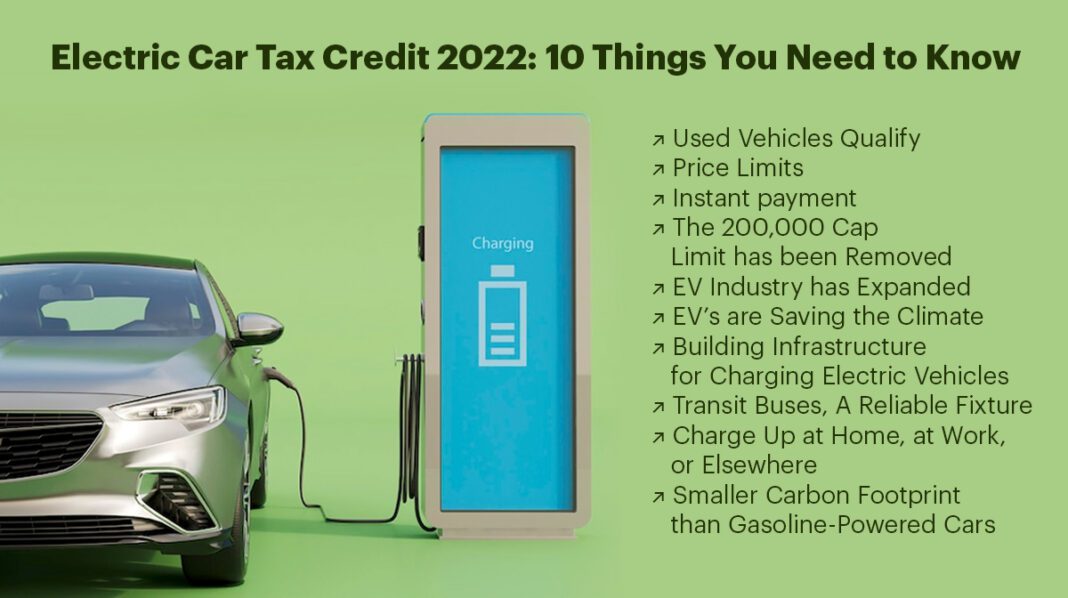

Electric Car Tax Credit 2025 10 Things You Need to Know EVehicleinfo, Vehicle registration tax (vrt) is a tax to be paid when and imported vehicle is registered in the irish state. Reliefs have been removed for any electric vehicles.

Let’s take a look at the main ev incentives available in ireland. €11.5 million has been allocated for grants this year via the espsv24 grant scheme, to enable owners of small public.

Reliefs have been removed for any electric vehicles.

Tax Incentives For Electric Vehicles Ireland. Currently, the €5,000 vrt relief on electric vehicles begins to taper off from €40,000, ending at €50,000. Incentives to purchase electric vehicles.

Overview Electric vehicles tax benefits & purchase incentives in the, You don't have to be an accountant to make sense of the savings you and. The irish government has announced a reduction of its subsidy for privately purchased electric vehicles.

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/irishtimes/UAD2ESD3FF4B6OMFYRKPJXCX2I.jpg)

Overview Electric vehicles tax benefits & purchase incentives in the, Pure battery electric vehicles (bev) < 62,000. Incentives to purchase electric vehicles.

Vehicle registration tax (vrt) is a tax to be paid when and imported vehicle is registered in the irish state.